Real Estate Market Showing Some Signs of Life in the New Orleans Area

After several years of declines, the metro New Orleans area real estate market appears to be stabilizing, according to new figures from the New Orleans Metropolitan Association of Realtors.

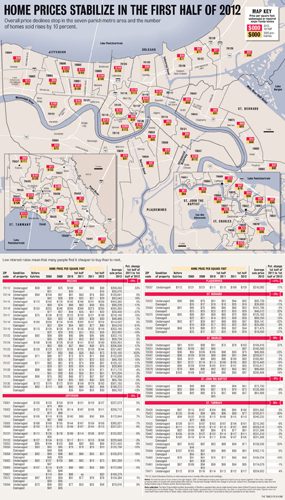

The price per square foot of homes in the seven-parish metro area was essentially unchanged in the first half of 2012 compared with the same period in 2011, but the number of homes sold increased by 10 percent, suggesting that the market is improving.

The results varied by parish. Plaquemines Parish led the way with a whopping 17 percent increase in price from spring 2011 to spring 2012. Orleans Parish continued its growth with a 5 percent appreciation in price. Results in St. Tammany and St. Charles parishes were unchanged. Jefferson, St. John the Baptist and St. Bernard parishes saw declines.

But the Realtors include in their analysis far-flung Tangipahoa Parish, which saw a 4 percent appreciation in per-square-foot home prices in the first half of the year. If one looks at an expanded eight-parish metro area, the results are positive, with the average price per square foot of a home posting a 3 percent increase in the first half of 2012 as compared with the same period in 2011, according to Wade Ragas, a former finance professor at University of New Orleans who analyzes data from Realtor-assisted sales twice each year.

But the gains are extremely fragile. Any recovery in the local housing market could be wiped out by a tremor in the economy, with U.S. gross domestic product weak, the Chinese economy faltering and Europe in a deep recession, Ragas said.

Meanwhile, the metro New Orleans area is showing no job growth, making it unlikely that a housing recovery will gain steam. “We have basically leveled off in new jobs,” said Janet Speyrer, associate dean for research and professor of economics at UNO’s College of Business Administration. “It’s barely growing.”

Some Areas Hit Harder

Indeed, some of the areas where the housing market is struggling the most are those with a dearth of jobs, such as eastern New Orleans and Slidell, which are suffering from the closures of the NASA Michoud facility and the Mississippi River Gulf Outlet waterway, while continuing to wait for new jobs from a new Walmart Supercenter and the reopening of the former Methodist Hospital. The wind-down of the Avondale shipyard continues to be a concern for the west bank of Orleans and Jefferson parishes.

map-homeprices-072212.jpgView full size

Still, there are anecdotal signs that the local housing market has improved in the first few months of 2012. Realtors with companies in different parts of the metro area say that the number of homes sold continues to increase and inventory backlogs continue to drop. Real estate companies also report that they have been hiring agents in the first few months of the year, and that Realtors are earning more money than they have been in a while.

Still, there are anecdotal signs that the local housing market has improved in the first few months of 2012. Realtors with companies in different parts of the metro area say that the number of homes sold continues to increase and inventory backlogs continue to drop. Real estate companies also report that they have been hiring agents in the first few months of the year, and that Realtors are earning more money than they have been in a while.

“The agents are much happier. Our volume is definitely up,” said Margie Inman, a Realtor with Coldwell Banker/TEC on the north shore.

Meanwhile, lenders are beginning to ease up on terms, and the notion that rates are unlikely to go lower is motivating some people to buy.

Mike Anderson, the president of Essential Mortgage, a company affiliated with Latter & Blum, said his company has broken two records set before Hurricane Katrina in the volume of mortgage lending in recent months, and the activity isn’t refinancing. “Business has been really good. When you do the math at 3.25 percent, there’s no question it’s cheaper than renting,” Anderson said.

‘Now Was a Good Time’

Attractive financing was a powerful motivation for Brian Brignac, 27, to buy a 1,400-square-foot home in March near Delgado Community College.

When Brignac looks back at his five and a half years of paying rent while he was a student at Louisiana State University in Baton Rouge, he feels as though he threw money away. So after graduating, he lived at home for a few years to save money while looking for a renovated home at an attractive price. “I wanted to build some equity, and have something for my next phase of life,” Brignac said. “With the market the way it was, I figured now was a good time.”

Brignac, who works as an auditor at People’s Health in Metairie, was able to qualify for the city’s soft-second mortgage program, which enables qualified buyers to get a forgivable loan of up to $65,000. So far, the city has closed 84 mortgages through the program.

Although Brignac’s house sold for $208,000, according to conveyance records, between his down payment and the soft second mortgage, the main mortgage is only about $120,000. With homeowner’s and flood insurance, Brignac said he pays about $1,200 a month for his home. “It worked out great,” said Brignac, who enjoyed riding his bicycle to Jazz Fest.

Elsewhere in Orleans Parish, full-on bidding wars have erupted. Artist Layla Messkoub, who moved to New Orleans from New York in 2009, decided after Jazz Fest that it was time to buy.

She loves Mid-City and is dying for something in Bayou St. John. She recently found a house she was really excited about, but within 12 hours there were 14 offers on the property. She raised her bid by 25 percent, and then raised it 25 percent again, but failed to get it. “It’s tough,” she said.

Messkoub continues to look. She has her eye on a house that she heard might go on the market, and hopes she can get it before it’s listed. “Maybe they’ll sell it to me,” she said.

Declines Are Abating

But not all parts of Orleans are strong, and other parts of the metro area continue to putter along without growth.

In New Orleans, parts of Uptown and Lakeview remain strong, and the Bywater experienced a 15 percent appreciation in price. ZIP codes in eastern New Orleans continued to see post-storm price declines, but the declines appear to be abating in Algiers and English Turn.

Sarah Peterson, manager of the Gardner Realtors office in Algiers, said she believes the housing market is beginning to improve because the number of days on the market has dropped slightly and the median price of homes sold has increased a bit. While the closure of the Avondale shipyard remains a concern for the west bank, the Federal City project in Algiers, the widening of the Huey P. Long Bridge and the opening of the NOLA Motorsports Park are all positives. “We’re hoping that will bring us more buyers,” she said.

In Jefferson Parish, per-square-foot home prices fell by 3 percent from the first half of 2011 to the first half of 2012 because of declines on the west bank and in Kenner, River Ridge and Harahan, but the number of homes sold increased by 7 percent. Prices appreciated in Old Metairie, Bucktown and Transcontinental and on the lakefront.

Mark Rodi, a Re/Max broker in Metairie, said that all the signs moved in a positive direction in the Old Metairie and Transcontinental areas from the first to second quarters of this year: The number of homes sold has increased, average home prices have increased and time on the market has declined. “I think that’s significant,” Rodi said.

In St. Tammany Parish, the overall price per square foot of homes sold was unchanged, but the number of homes sold was up nearly 19 percent since the first half of last year. Prices increased in the Covington, Abita Springs and Mandeville areas, but declined in the northern and eastern parts of the parish.

In St. Charles Parish, the overall price per square foot was unchanged, but prices on the east bank increased and prices on the west bank decreased because of the Avondale closing.

Outlook in St. John Is Good

St. John the Baptist Parish experienced a 9 percent decline in the average square foot price of homes sold, the worst of any parish in the metro area. But the number of homes sold increased, and the future employment outlook is positive because of the Nucor iron plant and growth at the Port of South Louisiana.

Frank Trapani, manager of Latter & Blum’s River Parishes office, said sales of existing homes are strong in St. Charles, but in St. John, there’s just not enough demand to see price increases.

St. Bernard Parish experienced a three percent decline in the price per square foot of homes sold from spring 2011 to spring 2012 on the same number of homes sold.

In Plaquemines Parish, the average price of a home in Belle Chasse rose to $316,000 in the first half of the year because of growth at the Naval Air Station and the relocation of the U.S. Marines to Federal City.