Purchasing a home doesn’t have to be a daunting task. With knowledge and tools, the homebuying process can be manageable with fewer obstacles than for those who just jump in headfirst. Here is a step-by-step guide to keep the homebuying process predictable and less stressful.

Purchasing a home doesn’t have to be a daunting task. With knowledge and tools, the homebuying process can be manageable with fewer obstacles than for those who just jump in headfirst. Here is a step-by-step guide to keep the homebuying process predictable and less stressful.

Before starting the process of even searching for a home always check your credit score first. The majority of homebuyers will need a mortgage or some sort of financial assistance. Your credit score can determine how much and what terms you will be given when borrowing money for a home. The higher your credit score the lower the mortgage interest rates. Your FICO score will be a deciding factor on whether a lender will qualify you for a loan. If your score is too low to qualify there are ways you can strengthen your score. Pay all of your bills on time, keep your credit card balances low, check your credit reports, keep credit cards open and have a variety credit (credit cards, loans, diverse credit lines etc.).

Set a downpayment goal before you start your search. It is crucial to get your personal finances in order. This makes the homebuying process run much smoother. How much you can put down on a home will be a factor in how much home you can afford. A down payment is the cash you will bring to the table at closing. This cash is what you contribute to the ownership of the home being purchased. Most lenders prefer 20% of the purchase price although less will be accepted. FHA loans will allow as little as 3.5% down, VA loans and USDA loans require no down payment. Note if you do decide to put down less than 20% you will be required to purchase private mortgage insurance (PMI).

Get preapproved for a mortgage before you go on your home search. Having a preapproval from a lender lets sellers and realtors know that you are serious about purchasing a home. Not only is it a ticket in the door, but it also helps determine how much house you can afford. A mortgage preapproval is a letter from a lender stating the amount of loan you can qualify for. A lender will typically evaluate your financial history by pulling your credit report and your score to determine what you can afford.

Have all your forms in order when submitting a mortgage application. You will need to gather the following, W-2 form from the past two years, paystubs from the past 30 days, proof of other sources of income, Federal tax returns from the past two years, recent bank statements, details on long-term debts (car or student loans) and ID and Social Security number. This seems like a lot of documents to hand over but remember your lender’s there to access this information and ensure you can make your loan payments on time.

Just like a home you want to choose the best mortgage that suits your needs. There are advantages and drawbacks to each type of loan. Choosing the right mortgage for your needs can help your chances of getting approved for a loan as well as save you thousands of dollars in the long run. There are conventional loans or government-back loans (FHA, VA or USDA) to choose from as well as a fixed-rate or adjustable-rate (ARM). The length of the loan is also a deciding factor, you can decide from a 10,15,20 or 30-year loan.

Shop around for the right mortgage lender. Just like any major purchase, you always shop around for the best deal you can get. Mortgage lenders can offer different incentives to entice business. When shopping around for a lender, make sure you know the current mortgage rates, are able to compare mortgage origination fees and receive at least three loan estimates from three different lenders to compare.

Your final step will be to close on your new home. This is an exciting moment but it can also be overwhelming. In order to ease the situation, become familiar with standard closing documents before you go to closing. Remember you can always negotiate for the seller to pay some of the closing cost.

Remember that a licensed Realtor can help you along the way. Finding the perfect home is personal. Some people want a certain school district while others want access to public transportation. Figuring out the features you can and can’t live without and choosing the right neighborhood is what matters.

Click Here For the Source of the Information.

The whole world is looking at the current economy closely. The U.S. economy is also under the microscope with states beginning to reopen. Several economists believe that the housing market will be the driving force to help get the U.S. economy back on track.

The whole world is looking at the current economy closely. The U.S. economy is also under the microscope with states beginning to reopen. Several economists believe that the housing market will be the driving force to help get the U.S. economy back on track.

Purchasing a home doesn’t have to be a daunting task. With knowledge and tools, the homebuying process can be manageable with fewer obstacles than for those who just jump in headfirst. Here is a step-by-step guide to keep the homebuying process predictable and less stressful.

Purchasing a home doesn’t have to be a daunting task. With knowledge and tools, the homebuying process can be manageable with fewer obstacles than for those who just jump in headfirst. Here is a step-by-step guide to keep the homebuying process predictable and less stressful.

Even though the pandemic shut the country down for a while, the housing market is still going strong. During April, new listings dropped and there was a weak supply and demand but that did not detour the housing market hardiness. In fact, with loosening social distancing restrictions open houses are now occurring and there is a surge in bidding wars for homes under $1 million.

Even though the pandemic shut the country down for a while, the housing market is still going strong. During April, new listings dropped and there was a weak supply and demand but that did not detour the housing market hardiness. In fact, with loosening social distancing restrictions open houses are now occurring and there is a surge in bidding wars for homes under $1 million.

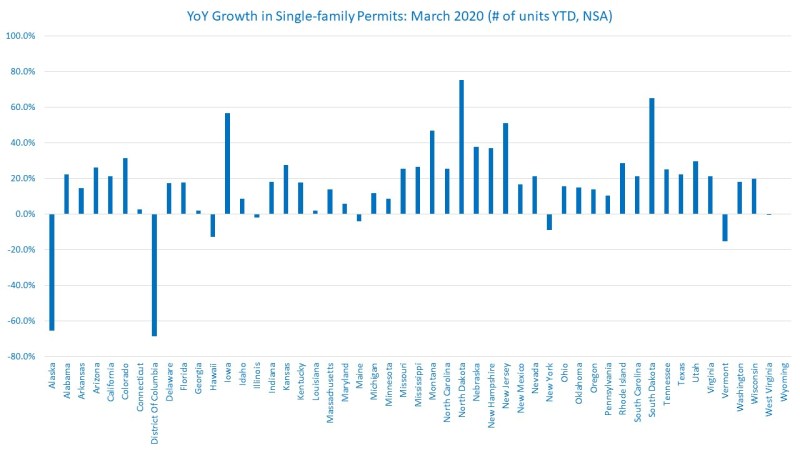

14.9% in the Northeast. Data collected between March 2019 (YTD) and March 2020 (YTD) shows that 42 states saw a rise in permits while seven states and the

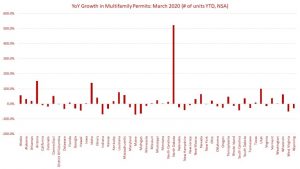

14.9% in the Northeast. Data collected between March 2019 (YTD) and March 2020 (YTD) shows that 42 states saw a rise in permits while seven states and the  across the country did not see an increase. The Northeast saw a 3.8% increase, the West a 10.7% increase but the Midwest saw -9.2% and the South a -1.2% decline. March 2019 YTD to March 2020 YTD saw a growth in 23 states. North Dakota was the highest with a rise of 523.5% in multifamily permits. Maine saw the largest decline of 71.7%. The 10 states with the highest number of multi-family permits issued combined was 64.9%.

across the country did not see an increase. The Northeast saw a 3.8% increase, the West a 10.7% increase but the Midwest saw -9.2% and the South a -1.2% decline. March 2019 YTD to March 2020 YTD saw a growth in 23 states. North Dakota was the highest with a rise of 523.5% in multifamily permits. Maine saw the largest decline of 71.7%. The 10 states with the highest number of multi-family permits issued combined was 64.9%.